Firefighting Aircraft Market Expected Strong Growth Through 2040

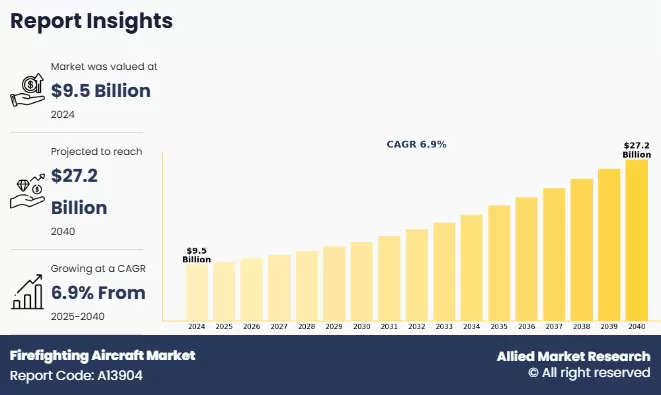

The global firefighting aircraft market was valued at $9.5 billion in 2024 and is projected for significant expansion, expected to reach $27.2 billion by 2040. This growth trajectory represents a Compound Annual Growth Rate (CAGR) of 6.9% from 2025 to 2040, highlighting increasing global investment in aerial firefighting capabilities. The Fire Fighting Aircraft Market is driven by several factors, including the rising frequency of wildfires and the need for enhanced response in high-risk industrial sectors like oil and gas.

Firefighting aircraft are specialized aerial vehicles, either designed or modified, for conducting operations to combat large-scale fires, particularly wildfires. They are indispensable tools for wildfire suppression, capable of delivering substantial quantities of water, fire retardants, or foam to affected areas that are often remote or difficult for ground crews to access.

The fleet of firefighting aircraft includes various types, such as fixed-wing planes like air tankers, scooper aircraft, and versatile multi-mission aircraft. Rotary-wing helicopters equipped with external Bambi Buckets or internal tanks also play a crucial role. These aircraft are deployed globally by governmental bodies, private contractors, and military forces. Their operational capacities vary widely, from massive air tankers dispensing thousands of gallons of retardant to smaller helicopters providing precise drops.

Modern aerial firefighting benefits from technological advancements, including sophisticated satellite tracking, AI-driven fire detection systems, and improved dispersal technologies, all contributing to enhanced efficiency in combating fires. As the incidence of wildfires increases worldwide, nations are actively expanding their aerial firefighting fleets, integrating newer technologies, and fostering international cooperation to improve disaster management and wildfire control efforts.

Market Dynamics Shaping the Firefighting Aircraft Sector

Several key dynamics are influencing the trajectory of the Fire Fighting Aircraft Market. Understanding these factors is crucial for stakeholders analyzing market opportunities and challenges.

Rising Use of Aircraft in Wildfire Suppression

The escalating frequency and intensity of wildfires across the globe are primary drivers of the demand for firefighting aircraft. Traditional ground-based methods are often insufficient to contain large wildfires, especially in challenging terrains. Aerial assets offer a critical advantage by rapidly reaching affected zones and delivering large payloads to prevent fire spread effectively. This has prompted governments and firefighting agencies to expand their aerial fleets, leading to increased procurement and modernization initiatives.

For example, in March 2025, the Canadian Commercial Corporation (CCC) finalized a government-to-government contract with France’s Directorate General of Armaments (DGA) for two De Havilland Canadair 515 aircraft. This acquisition is set to significantly bolster the french fire fighting aircraft fleet, enhancing France’s capacity to tackle increasing wildfire threats. The Canadair 515, known for its high water-carrying capacity and swift deployment, is expected to improve fire suppression efficiency.

Technological progress in firefighting aircraft, such as larger tank capacities, potential for autonomous operations, and enhanced maneuverability, is further stimulating market demand. The growth is also supported by public-private partnerships and international collaborative efforts aimed at fleet expansion. With climate change projected to exacerbate wildfire risks, investment in aerial firefighting solutions, and consequently the demand for firefighting aircraft, is anticipated to rise globally.

Increase in Fire Incidents in the Oil & Gas Industry

The growing number of fire-related incidents within the oil and gas industry is also contributing significantly to the demand for specialized firefighting aircraft. Oil refineries, offshore drilling platforms, and storage facilities present high fire risks due to the presence of volatile substances, where fires can spread rapidly. Traditional methods are often inadequate in such hazardous industrial settings, making aerial firefighting capabilities essential for rapid response and containment.

Specialized fixed-wing and rotary-wing aircraft equipped with advanced fire retardant and water-dropping systems are vital for mitigating damage and preventing catastrophic losses in these environments. Both governmental bodies and private sector entities are increasingly investing in these specialized aircraft to strengthen their emergency response in high-risk industrial areas. Furthermore, the adoption of Unmanned Aerial Vehicles (UAVs) for monitoring fire hazards and assessing situations in oil and gas infrastructure is also supporting market growth by improving safety measures and operational resilience. Opportunities for fire fighting aircraft for sale are increasing as these sectors invest in better protection.

Challenges: Delayed Aircraft Deliveries

Despite strong demand, the fire fighting aircraft market faces challenges, notably delayed aircraft deliveries. Procurement delays stemming from disruptions in global supply chains, manufacturing bottlenecks, and complex regulatory approval processes are causing setbacks in fleet expansion and modernization efforts worldwide.

These delays result in operational gaps for governments and firefighting agencies, hindering their ability to respond effectively to the increasing number of wildfire incidents. As the demand for advanced, high-capacity firefighting aircraft grows, extended lead times, higher costs, and limited availability of essential aerial resources become significant issues. This impacts disaster preparedness, sometimes forcing agencies to rely on older fleets or temporary leasing solutions, which may not offer optimal effectiveness. Moreover, prolonged delays can deter potential buyers, thereby slowing market growth. Addressing these issues through streamlined production processes, expedited approvals, and building more resilient supply chains is critical to ensuring timely availability of aircraft and improving global wildfire response capabilities.

Firefighting Aircraft Market Segmentation Insights

The global firefighting aircraft market is analyzed based on several key segmentation criteria, providing a detailed view of its structure and trends.

By maximum takeoff weight, the market is segmented into less than 8,000 KG, 8,000 to 30,000 KG, and more than 30,000 KG. The segment covering aircraft with less than 8,000 KG maximum takeoff weight generated the largest revenue in 2024. This reflects the widespread use of smaller aircraft and helicopters for initial attack, reconnaissance, and support roles.

Based on aircraft type, the market is divided into fixed-wing (airplanes) and rotary-wing (helicopters). Fixed-wing aircraft held the largest market share in 2024. This is primarily due to the effectiveness of large air tankers and scooper planes in delivering massive volumes of retardant or water over large areas. Governments and private operators are investing in both types to enhance overall firefighting capabilities and response times.

Tank capacity segmentation includes less than 10,000 liters, 10,000 to 30,000 liters, and more than 30,000 liters. Increased fire incidents, particularly wildfires and industrial fires, drive demand across all capacity ranges. Aircraft with larger capacities are crucial for tackling massive blazes, while smaller ones offer agility and precision.

Range segments include less than 1,000 KM, 1,000 to 3,000 KM, and more than 3,000 KM. The 1,000 to 3,000 KM range segment is identified as a leading area in the market, reflecting the need for aircraft capable of reaching distant fire zones while also having sufficient endurance for operations. The surge in long-term contracts presents lucrative opportunities for sustained business growth in this sector.

Regionally, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). North America is projected to be the most lucrative region during the forecast period (2025-2034). This is largely due to the high frequency of wildfires in countries like the U.S. and Canada, coupled with significant government investment in aerial firefighting assets and infrastructure.

Competitive Landscape and Key Developments

The global fire fighting aircraft market is moderately fragmented, featuring several prominent players. Key companies include SAAB, ShinMaywa Industries, Ltd., COULSON GROUP, Conair Aerial Firefighting, Lockheed Martin Corporation, Kaman Corporation, AIRBUS, Textron, Inc., Leonardo S.p.A., and De Havilland Aircraft of Canada Limited. These vendors utilize various strategies, including contracts, partnerships, and expansions, to enhance their market position.

Recent key developments highlight strategic moves by market players:

- In January 2025, Conair acquired a Daher TBM 960 aircraft to bolster its wildfire suppression capabilities. The aircraft’s speed and efficiency are seen as valuable for rapid response.

- In November 2023, Saab secured a new contract with the Swedish Civil Contingencies Agency (MSB) to continue providing aerial firefighting aircraft, crew, and logistical support, ensuring robust capability for Sweden.

Strategic partnerships between manufacturers, agencies, and leasing companies are facilitating access to modernized fleets, improving operational efficiency. Long-term agreements are also strengthening international cooperation and fostering advancements in aerial firefighting capabilities.

Top Impacting Factors and Historical Context

The fire fighting aircraft market is expected to exhibit significant growth. Key factors driving this growth include the increasing need for next-generation engines and transmission units in aircraft, the growing adoption of lightweight components, and rising military and government expenditure on aerial capabilities. Furthermore, the increasing integration of advanced airframe technologies and the overall surge in aircraft fleets globally, alongside technological advancements, are anticipated to provide substantial opportunities for market expansion during the forecast period.

Historically, the market has been competitive due to the presence of established vendors. Companies with significant technical and financial resources hold a competitive edge by being better equipped to meet the market demands. The competitive environment is expected to intensify further with ongoing technological innovations, product developments, and diverse strategic approaches adopted by key players.

Conversely, the market faces limitations such as technical issues associated with complex firefighting aircraft systems and stringent regulations governing aircraft components, which can constrain market demand. Delayed deliveries, as mentioned earlier, also continue to pose a challenge.

In summary, the global firefighting aircraft market is poised for substantial growth, driven by the critical need to combat increasing wildfire threats and enhance safety in high-risk industries. While challenges like delivery delays exist, ongoing technological advancements and strategic collaborations are expected to support market expansion and improve global aerial firefighting capabilities.